Parents

3 WAYS TO TEACH YOUR CHILD BUDGETING: 50-30-20 RULE

Fri Jul 14 2023 - 4 mins

Blossom Amara

Writer, Little

Back to Blog

Share Post

3 WAYS TO TEACH YOUR CHILD BUDGETING: 50-30-20 RULE

As Parents, we want to equip our children with essential life skills and one of the most crucial skills is Financial Responsibility. Teaching your child how to budget at an early age can set them up for a lifetime of financial success. One effective method is introduce budgeting to your child is through the 50-30-20 rule. In this blog post, we will explore three practical ways you can teach your child about budgeting using this rule.

Start with the Basics

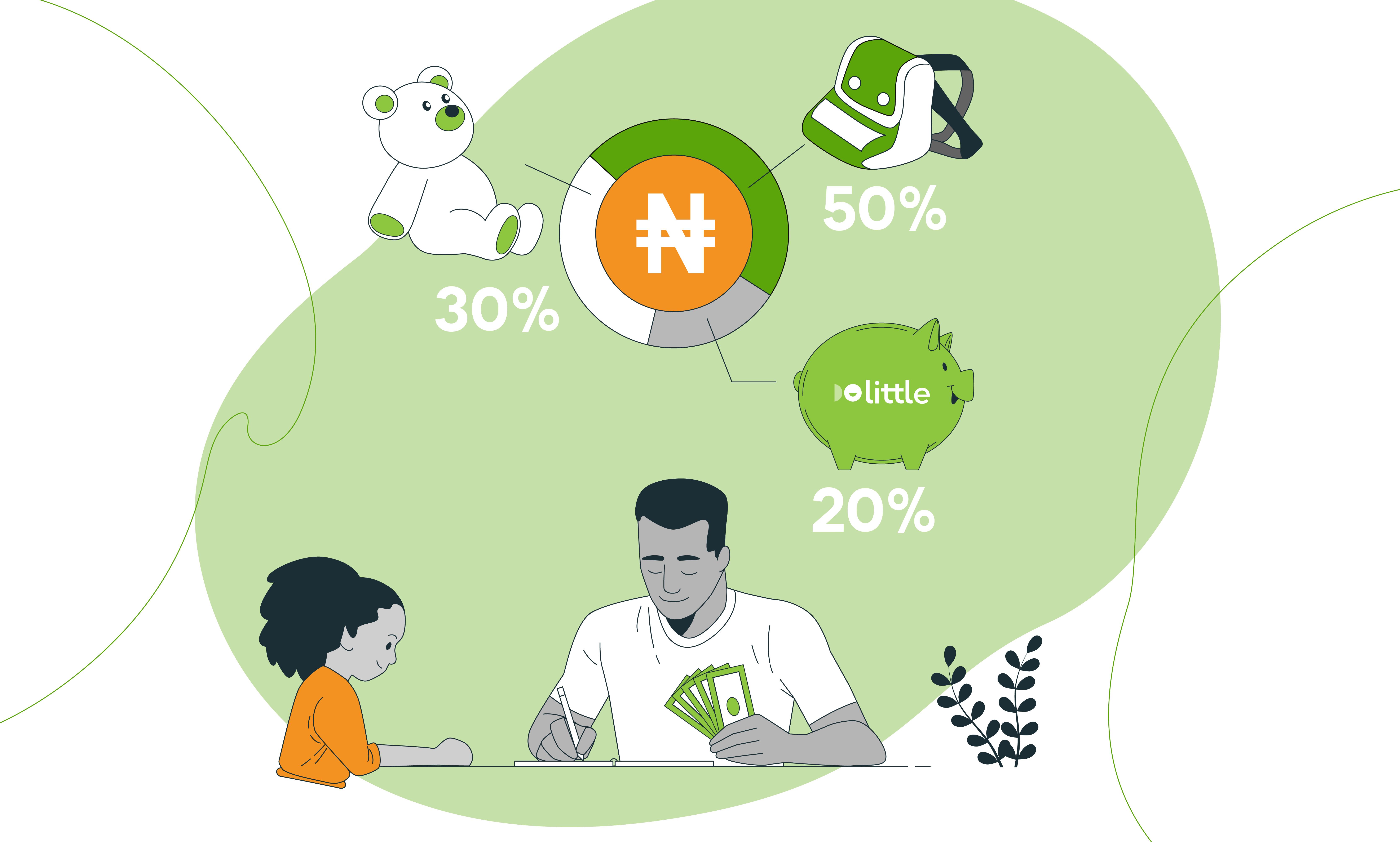

The 50-30-20 rule is a simple and easy-to-understand budgeting concept that helps people manage their finances effectively. Explain to your child that this rule suggests dividing their income or allowance into three categories: needs, wants, and savings.

- Needs (50%): Teach your child that 50% of their income should be directed towards their essential needs, such as food, clothing, school supplies, and transportation. This teaches them the importance of prioritizing necessary expenses.

- Wants (30%): Encourage your child to allocate 30% of their income towards their wants, such as toys, hobbies, entertainment, and outings with friends. This category teaches them the value of moderation and delayed gratification.

- Savings (20%): Teach your child to save 20% of their income for future goals and unexpected expenses. Help them open a savings account or provide a piggy bank where they can deposit their savings regularly. This category instills the habit of saving and prepares them for financial emergencies.

Set Goals and Track Progress

To make budgeting more engaging for your child, involve them in setting financial goals and tracking their progress. This approach not only empowers them but also instills a sense of responsibility. For example;

- Goal Setting: Sit down with your child and discuss short-term and long-term goals. Short-term goals can be saving for a new toy, while long-term goals can include saving for a special trip or college education. Encourage them to break down these goals into achievable milestones.

- Track Progress: Help your child visualize their goals, such as a savings chart or a table representing the amount saved. Regularly review and celebrate their progress to keep them motivated and engaged in budgeting.

Encouraging Wise Spending Choices

Teaching your child the importance of making wise spending choices is essential for effective budgeting. Here are some strategies you can employ;

- Comparison Shopping: Teach your child to compare prices and quality before making a purchase. Explain how doing so can help them make informed decisions and stretch their money further.

- Delayed Gratification: Encourage your child to wait before making impulsive purchases. Teach them the concept of delayed gratification by explaining that waiting can often lead to better deals or finding something they truly value.

- Value of Money: Involve your child in everyday financial decisions like grocery shopping or paying bills. This helps them understand the value of money and the effort required to earn it.

Teaching your child budgeting skills using the 50-30-20 rule equips them with invaluable tools for managing their finances responsibly.

By starting with the basics, setting goals, and encouraging wise spending choices, you are nurturing their financial literacy from an early age.

Remember, financial education is a lifelong process, and by instilling these skills in your child now, you are setting them up for a more secure and prosperous future. Do you want more tips on how to groom your children? Follow us on Instagram and Facebook

Back to Blog

Share Post

Latest releases

Sat Feb 17 2024 - 5 mins

HOW TO MAKE YOUR CHILD A MILLIONAIRE IN 10 YE...

Mon Jan 29 2024 - 2 mins

How do I stop my child from Overspending?

Thu Jan 25 2024 - 4 mins

My Child is Being Bullied- What do I do?

Fri Jan 19 2024 - 3 mins

The Little Money Fest: A Money Event for Ever...

Want updates straight to your inbox?

Subscribe to our newsletter for tips, guides and news

Good money habits for your child starts here. Empower your child to financial responsibility.